Canada is a developed country occupying half of North America, and its land area is second only to Russia. The development of Canada's cement industry has been weakened recently due to the global economic recession, but the dawn of a turning point is also faintly visible.

Canada was originally occupied by indigenous people, and today's inhabitants are mostly descendants of explorers from France and Britain in the 15th century. At the beginning, France and Britain established a large number of colonies along the Atlantic coast, but they often clashed with each other. In 1763, France was defeated and handed over most of its territory to Britain.

Canada's history as a nation can be traced back to 1867, when a large number of British and French colonies joined together to form an alliance called the British North American colonies. In 1931, Britain began process of allowing Canada to increase its autonomy, and it was not until 1982 that Canada finally achieved political independence from Britain.

Today, Canada is a parliamentary democracy consisting of 10 provinces and three border regions. The British monarch is still the head of Canada, one of the 53 Commonwealth countries.

I. Economic Overview

Canada is a highly developed market economy country with a total GDP of more than $1.8 trillion. Its largest trading partner is the United States, which accounts for 75% of exports and 50% of imports. The Canada-United States Free Trade Agreement of 1988 facilitated their interaction, and in 1994, the North American Free Trade Agreement was signed.

Despite the high level of interaction between Canada and the United States and a large number of cultural and linguistic ties, the overall level of taxation and social security in Canada is higher than that in the United States.

Canada's economic development was not significantly affected by the global recession, as activities in the banking sector were restricted earlier. After the 2008 deficit, Canada is expected to face another surplus economy in 2015, after the previous economic development law showed that there would be a surplus situation every 12 years.

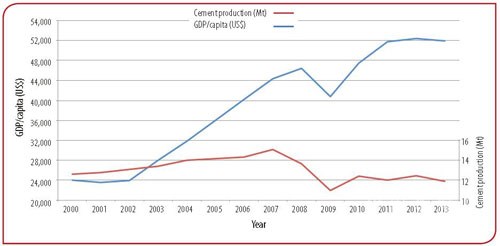

Figure 1: Trends in Canadian GDP per capita and cement production, 2000-2013 (USD, Mt)

Source: USGS, World Bank

Like other developed countries, the majority (76%) of Canada's workforce is concentrated in the service sector, with manufacturing and industry accounting for 19% and agriculture accounting for 1%. In addition, Canada had an unemployment rate of 7% in 2014.

Canada's financial sector, rooted in Toronto, is crucial, along with the forestry sector and crude oil production. Canada is the third largest oil producer after Venezuela and Saudi Arabia, with 173 billion barrels of oil explored, mostly in the Alberta region of the Western Canadian Sedimentary Basin. In 2013, Canada's oil and gas industry contributed 10% of GDP. However, the recent sharp drop in oil prices has had a negative impact on economic growth in major oil provinces such as Alberta, Saskatchewan, Labrador and Newfoundland, where the energy sector accounts for more than 30% of GDP.

II. Cement production trend

As shown in Figure 1, Canadian cement production increased steadily from 12.6 million tons to 15.1 million tons between 2000 and 2007, with an average annual growth rate of 2.7%. In 2008 and 2009, the output declined for two consecutive years, with 13.7 million tons and 11 million tons respectively. After 2009, Canada's cement production began to grow unsteadily. It recovered strongly by 13.8% to 12.4 million tons in 2010, but fell back by 3.6% in 2011. It grew by 3.9% year-on-year in 2012 and then fell by 4.4% in 2013.

According to the data of Canadian Cement Association, the national cement output from January to November 2014 was 11.5 million tons, an increase of 1.7% over the same period last year, which was also slightly higher than output level of 11.4 million tons in the previous year.

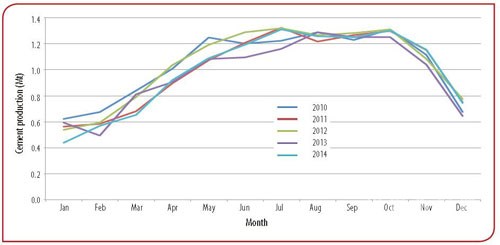

Figure 2: Monthly cement production in Canada, 2010-2014 (million tons)

Source: Statistics Canada

Figure 2 shows the trend of monthly cement production data in Canada from 2010 to 2014, in which there are two key points: first, the seasonal periodicity of cement production: cement production from May to October accounts for 64% of the whole year, and cement production from November to April accounts for 36%. This is related to fluctuations in building construction, and further, to Canada's continental climate, where temperatures can be as high as 35 degrees Celsius in summer and as low as minus 25 degrees Celsius in winter. Second, the graph reinforces the fact that Canadian cement production has changed relatively little over the past few years.

III. Export trend of cement

Canada is a net exporter of cement, and the United States has historically been the leading export destination. However, with the decline in cement consumption in the United States, Canadian cement exports in the past decade have fallen from 5 million tons in 2004 to 3.1 million tons in 2014. In 2014, Canadian cement exports accounted for about 25% of total production.

Figure 3: Canadian cement exports (million tons) , 2004-2014

Source: Statistics Canada

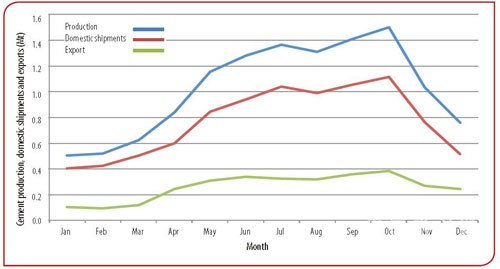

Figure 4: Canadian cement production, domestic shipments and exports in 2014 (million tons)

Source: Statistics Canada

[Page]

IV. Overview of provincial cement

Canada has a vast territory, and some provinces are several times larger than some countries. Because of the extreme climate (especially in the far north), the population density of Canada varies greatly from region to region. A large number of people are concentrated in the southern provinces near the U.S. border, and more than 90% of Canadians live within 200 kilometers of the United States. As a result, cement plants and cement transportation in Canada are also very different. In the Far North Nunavut Territory, which accounts for more than 20% of Canada's territory, there are only 30,000 people.

Statistics Canada attempts to measure the amount of cement shipped between provinces and territories within its borders, but for competitive reasons, it is not complete, especially when there are only a few or two factories in a very large area.

However, it is possible to find some key points from the data of the Bureau of Statistics. So far, Ontario is the largest consumption base in Canada, with 3.1 million tons of cement in the region in 2014, more than one third of the 9.2 million tons shipped in Canada. Quebec, the second largest cement consumption province, has 1.9 million tons of cement logistics in the region, which is about 20% of the national total. In addition, the prairie provinces of Alberta, Saskatchewan and Manitoba together consume 2.8 million tons of cement, about 30% of the country's total. The remaining eight provinces and territories, with a total of 18% of the population, consume 1.4 million tons of cement, or about 15% of Canada's total cement consumption.

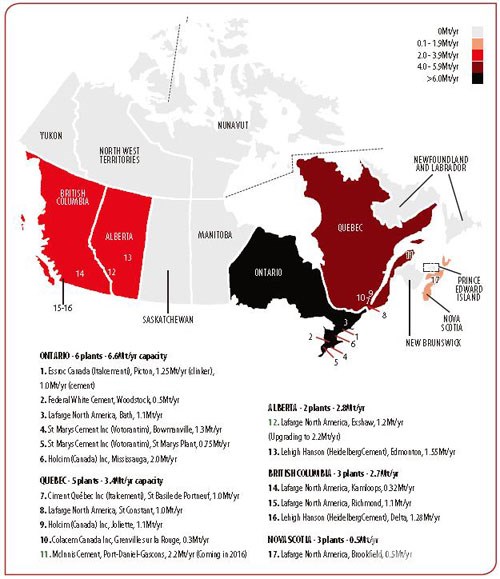

Figure 5: Canadian cement production map (shades of color correspond to cement production capacity)

Source: Global Cement Directory 2015

V. Cement manufacturer

Canada's cement industry consists of 16 integrated cement plants, all of which are currently in production, with a cumulative annual cement capacity of 18.8 million tons, but the industry has never reached such a high level of production in recent years. In 2014, the capacity utilization rate of the industry was about 61%. There is no pure grinding station factory in the country. Multinational companies such as Lafarge, Holcim, Heidelberg Cement, Italcementi and Votlantin have 15.2 million tons of capacity per year, accounting for 81%, in addition to some small local enterprises.

Lafarge : French multinational Lafarge has the largest and most widely distributed cement production platform in Canada through Lafarge North America, which operates six cement plants in five Canadian provinces with an annual capacity of 5.2 million tons.

Lafarge's largest cement plant is the 1.2 million tonne per year Exshaw plant in Alberta, which is currently being overhauled and will have a production capacity of 2.2 million tonnes per year upon completion. Heinz Knopfel, the plant's manager, said in 2014 about the project that "cement consumption in the Alberta region has grown exponentially over the past few years".

Other plants are located in Ontario (1.1 million tons/year), Quebec (1.0 million tons/year), Kamloops (320,000 tons/year), Richmond (1.1 million tons/year), and Nova Scotia (500,000 tons/year).

Holcim (Canada): Holcim is currently the second largest producer in Canada, operating 3.3 million tonnes per annum (mtpa) from two locations in eastern Canada. Holcim entered the Canadian market through a stake in St. Lawrence Cement, which started in 1951 and closed its original cement plant. Holcim officially launched the company name Holcim Canada in 2009.

Holcim Canada's Quebec plant is located north of the city of Montreal and has an annual capacity of 1.1 million tons. The cement plant was built in 1965 and acquired by St. Lawrence Cement in 1976. The plant has been using tyres and waste fuel as alternative energy sources since 1991, and added a granulated plastic waste feeding system in 2002.

Holcim's Mississaugh processing plant has a capacity of 2 million tonnes per year, and there are two cement plants nearby, one producing 2.7 million tonnes of Portland cement and the other producing 500,000 tonnes of GranCem cement.

Caspian Hansen (Heidelberg Cement): Canada's third largest cement producer, Heidelberg Cement participates in the cement market through Caspian Hansen in Western Canada. Heidelberg acquired the Canadian assets of Caspian Cement in 1993 (Caspian Cement entered the Canadian market as early as 1956), and merged the assets into the Caspian Platform after the acquisition of Hansen in 2007, but used the company name of Caspian Hansen. Today, Caspian Hansen operates two cement plants with a total annual capacity of 2.83 million tons.

St Mary's Cement (Waterland Pavilion), which dates back to 1912, currently operates two cement plants with an annual capacity of 750,000 tons and 1.3 million tons respectively. In addition, there are Italian Cement, Federal White Cement and Colacem Canada.

Six, CRH old castle bid for Lahao assets

On January 30, 2015, Old Castle (CRH), an Irish building materials group, announced that it was negotiating an asset merger with Lafarge and Holcim. Lafarge and Holcim had to sell some of their assets in order to get their merger through. All assets and facilities of Holcim Canada are included in the proposed sale. This means that if the acquisition is completed as scheduled, Old Castle will take over two cement plants in Mississauga and Joliet, Canada, with an estimated value of about $884 million.

VII. Industry Outlook

Canada's strong economy has been hit in recent months by the continued decline in crude oil prices. In January 2015, the International Monetary Fund lowered its economic growth forecast for Canada, predicting that Canada's GDP will grow by 2.3% year-on-year in 2015 and 2.1% year-on-year in 2016. In the same period, the global economy is expected to grow by 3.7% and 3.5% respectively.

The Canadian cement industry faces some uncertainty, given the Lahau merger and the new capacity in Quebec, as well as oil prices. In order to cope with the weakness of domestic demand, Canada's dependence on US exports may increase.

浙公网安备33010802003254号

浙公网安备33010802003254号